This post may contain affiliate links, meaning if you decide to make a purchase via my links, I may earn a commission at no additional cost to you. See my disclosures for more info.

Have you been wondering how people start short term rentals and thinking what Airbnb investment strategies do they employ? I have for sure and I’m here to show you the 6 most common strategies used by hosts across the country. I’ll show you each investment strategy and which one I think is the best overall.

There are so many different directions you can take it and not everyone is created equal. So get a cup of coffee and let’s dive into all things Airbnb investment strategy.

This post is all about Airbnb investment strategies.

6 Airbnb Investment Strategies

1. Airbnb arbitrage

If you’re looking into the Airbnb hosting world, I’m sure you have come across this strategy. Most of the gurus that teach this strategy claim it’s a fast way to make a profitable business out of Airbnb without owning any property. So here’s the strategy, you find a great house or apartment to rent from a landlord, sign a lease that allows you to repost on Airbnb and then you furnish and manage the rental. Most of the time the sell to the landlord is that they don’t have to pay for professional property management and that you will fix small repair items for them and it will be a better taken care of place than any long term tenant.

Honestly, this strategy is not a bad idea if you do not own any real estate. I think there are a lot people out there doing it right now so the competition could be deep. But ulitmately, if you know how to operate a great short term rental, this could be a low cost way of getting started. Your expenses for start up would be the rental deposit, first months rent and furnishing costs. Could easily be done on a $10k budget with a small property!

Are you starting your first Airbnb property? Use my link to earn an extra $40 from Airbnb when you host your first guest!

2. Renting out a room

Did you know this is how Airbnb originally started? I listened to a great podcast that interviewed the founders of Airbnb and they shared how this is the heart of the company. They wanted to disrupt the travel industry by creating a unique ecosystem of hosts that would invite guests into their lives. It’s so interesting because travel these days is all about an experience and this would be quite the experience to host guests in your home!

The best way to see what your room would be worth per night is to go to Airbnb and run your area through their calculator. If you own your own home, have some spare bedrooms and want to host guests traveling to your area, this is a great strategy to leverage to get started. This is a super low cost solution and could be as low as the cost of bedroom furniture.

3. Renting out a guest house

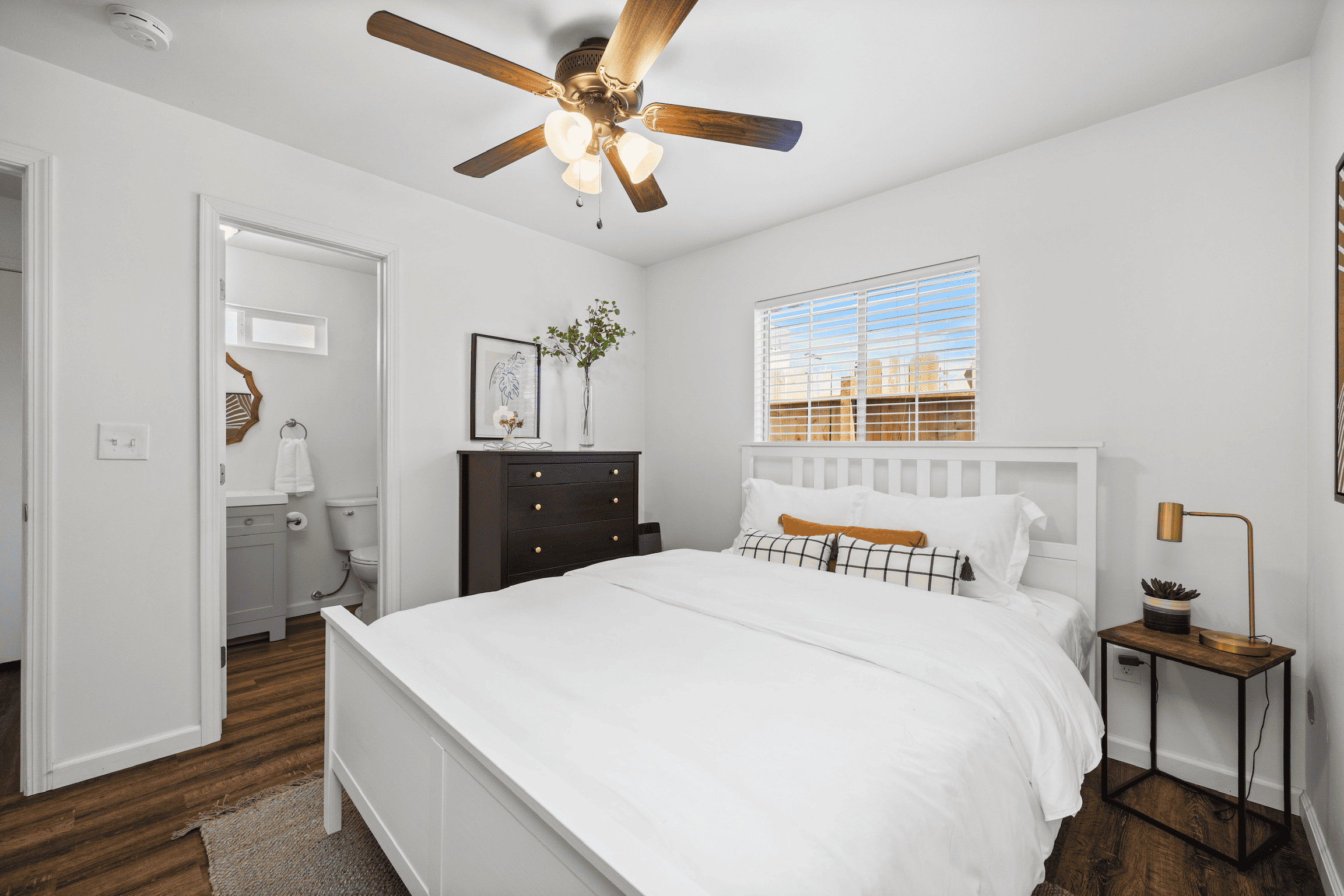

This is my personal favorite strategy because this is what I did! My husband and I bought our second house in 2018 that had a guest house on the property. We were going to rent it out to a long term tenant but were bummed because we wanted to be able to use it for friends and family when they came to visit. Long story short, we took the plunge and posted it on Airbnb. We thought we’d maybe be able to get $1,500 per month for long term tenants and our first month on Airbnb, we did $3,400 in revenue! What a difference.

We did a full remodel on this guest house and then furnished it. It was more expensive than we had originally planned but so worth it looking back over these last 5 years. This was the best way to learn short term rental operations and such a great side hustle at the time. It’s with this property that I developed out my Airbnb automation strategy and now manage that property, which has over a 4.9 star rating, fully remotely. If you’re interested in my strategy, fill out the form below and I’ll let you know when my new product comes out that will show you how to fully automate your Airbnb business!

4. Converting a long term rental into a short term rental

If you’ve been investing in real estate for awhile, it’s no secret that there are just some properties that are headaches. We own a property in a C class neighborhood. I don’t think would normally be a good fit for Airbnb, but, it’s super close to the major hospitals and business in this town. So we decided to take the plunge and furnish after a couple years of bad long term tenant experiences. Holy cow what a risk but what a great idea in the long run! That place is always full and does 3x the revenue it did as a long term. We are not shy about the area in our listings but our traveling professional guests love this property. We added key safety features to ensure our guests always feel safe. We’ve never had any issues but always go the extra mile for our guests.

If you’re in a similar boat with a long term rental, I would encourage you to run the numbers through Airdna to see if the numbers make sense versus a long term rental. Furnished finder is another great resource to advertise and rent out your furnished houses to corporate travelers. There is so much opportunity to grow your revenue with your real estate if you’re willing to learn a new strategy.

5. Airbnbing your primary residence

Airbnbing your primary residence 14 days per year can be done tax free! (Check with your CPA because I am not a tax expert). But this is a great way to try out Airbnb. If you’re open to letting strangers stay in your home this could lead to an extra couple thousand dollars a year and enough to cover your vacations.

I have a friend that does this every year for special events that are coming to town. They get a killer ADR and leave on vacation while the guests are staying at their property. Such an awesome strategy that everyone can use!

If you’re looking for a step by step guide on putting your house on Airbnb, check out this article here!

BONUS: Buying a house for Airbnb

The final strategy, and by far my most favorite, is buying a property specifically for Airbnb. You get the high revenue, real estate ownership benefits with depreciation and write offs. I have saved up my cashflow from other rental properties to buy more Airbnbs year over year. I now have up 7, almost 8 live listings on Airbnb. What a difference the cashflow makes versus long term rentals.

What strategy do you use? I’d love to know in the comments below!

This post was all about Airbnb investment strategies.

This post may contain affiliate links, meaning if you decide to make a purchase via my links, I may earn a commission at no additional cost to you. See my disclosures for more info.

This looks fascinating!! I’ve wanted to look into running an airbnb!!

These were some great strategies. I’ve often thought of planning to enter the Airbnb industry whenever things align. Thanks for sharing this.