This post may contain affiliate links, meaning if you decide to make a purchase via my links, I may earn a commission at no additional cost to you. See my disclosures for more info.

Are you wanting to get started on Airbnb but feel like you need an Airbnb business plan? I went to business school and remember taking a class on how to properly write a business plan to get my idea off the ground. There’s a very specific format you have to follow and it was so intimidating!

Trust me when I say that overcomplicating anything is not the way to get started. That’s why I am going to take you through my exact Airbnb business strategy to simplify the process so you can do what matters most…just getting started!

This post is all about Airbnb business plan writing.

The Ultimate Airbnb Business Plan

What you need to know to get started

Developing an Airbnb business plan is simple. You need to understand yearly revenue, minus expenses to see if it’s a profitable venture. So many investors over complicate it with bringing in cash on cash return ratios and asking what returns investors want to be receiving. I was always so confused by that when I first started because all I wanted was to cash flow. Now, my best property has a yearly COC return of 71% so I’ve learned a thing or two over the years but my point here is, the gurus tend to confuse newbies with this language. Don’t let it confuse you.

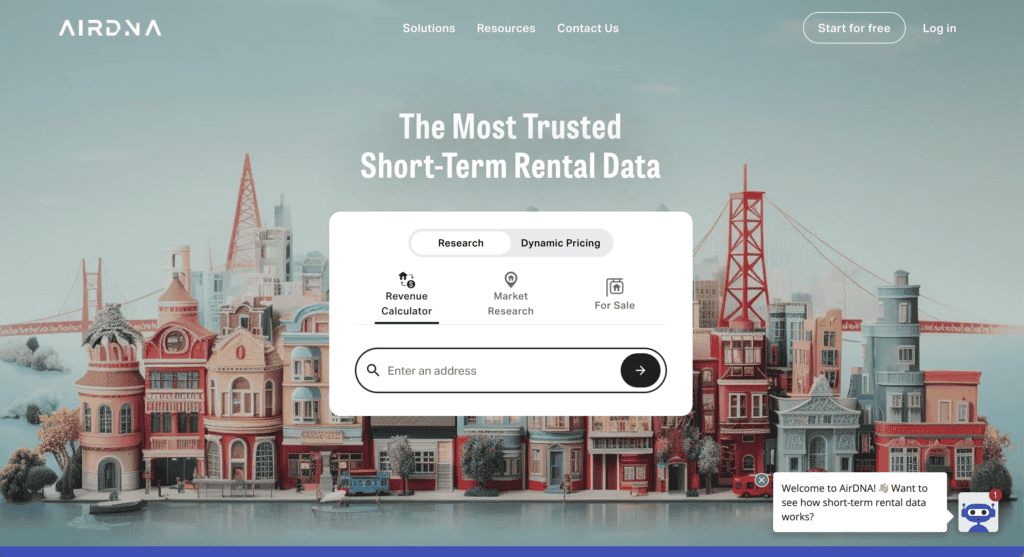

How to calculate yearly revenue

The first thing you’ll want to do is calculate your yearly revenue. There’s so many great tools to do this on. Even Airbnb has their own tool. But my favorite is Airdna. You can create a free account on there and plug in any address to their Revenue calculator and it will generate your yearly revenue, occupancy rate and operating expenses for free. It also gives you a market score that I don’t really understand and honestly I don’t pay attention to it.

Here’s how I run my numbers on Airdna

When you get to the landing page, you’ll need to create a free account in order to use the Revenue Calculator feature. Once you have the free account set up, you’ll want to leverage the Revenue Calculator to type in the address to your listing.

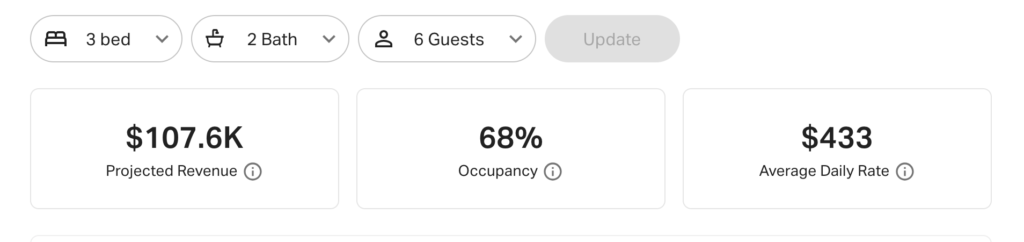

Once you type in the address to your address, you will want to make sure the bedroom, bathroom and guest count is accurate. This will make sure you have the right Project Revenue, Occupancy Rate and Average Daily Rate for your listing.

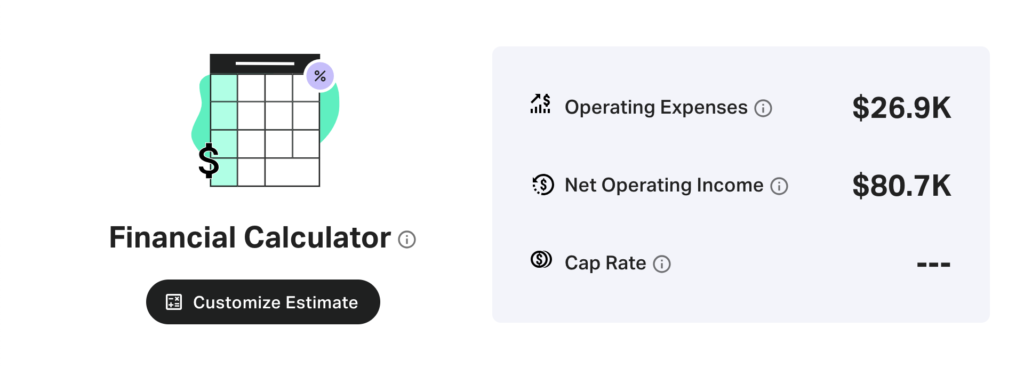

Under these metrics you’ll find the operating expenses and the net operating income. Now the net operating income and operating expenses are not inclusive of everything. You’ll want to read further to understand what else you need to include in your operating expenses.

Run the numbers

Now that you have your yearly revenue, operating expenses and occupancy rate, let’s see how much you’ll make. Now that you have all these projections, you can pull in your property expenses. Those are generally your mortgage, insurance, utilities, pest control, lawn care and pool cleaning. Airdna calculates your revenue and operating expenses (usually cleaning and light maintenance) on a yearly basis and your other expenses come monthly.

What so many investors get confused is they want to see monthly revenue projections but Airbnb is a seasonal business. Meaning, you’re going to do more revenue in certain seasons and less in others so it’s best to calculate your numbers on an annual basis. In fact, there are many markets that will do 90% of their yearly revenue in 5 months.

So for running the numbers, you will need to take all your monthly expenses and multiply it by 12 to get your annual expenses. Take your revenue, minus your total operating expenses and you get your cash flow. Hopefully that number is positive! If not, move on to a new property.

Taxes

So if you found a property that is cash flow positive, congrats! You’re on the right track. Many of you are probably wondering how taxes are calculated. You will be taxed on the cash flow but there are other benefits like depreciation that can offset your tax burden. Or you can reinvest your cash flow into a new property so your business always looks like it has a net loss on your schedule E at tax time. Regardless, you will want to save for taxes. Personally, I put away 10% of my total revenue (not cash flow) aside for taxes each year.

*I am not a tax professional so please ask your CPA before taking any advice. I am disclosing what I do personally and it’s not going to work for every investor.

Let’s talk occupancy rate

When I first started I saw occupancy rates as a challenge. I literally thought, “oh yeah only 40% occupancy? I bet I can do 70%!” Knowing what I know now, higher occupancy does not always mean higher profits. Usually expenses, cleaning cost and utilities will go up if you’re hosting guests more than the occupancy rate recommends. Generally, if you’re filling your calendar more than other hosts in the area, your nightly rates are not where they should be. Meaning you’re leaving money on the table every night you’re hosting. Also, the discount guest is usually the roughest on your furniture and much more needy than other guests. This increases your time in your business or your teams time and higher expenses over the long run.

As a rule of thumb, don’t think you can blow the occupancy rate out of the water because you probably should not be. The worst feeling when you’re first starting a property is not getting bookings so it can be super tempting to drop nightly rates to fill the listing. Do not make this mistake! Once you get a year under your belt, you can adjust your strategy and move forward.

Know your desired outcome

Now that you know the numbers, what is your desired outcome? Is your goal to live off the cash flow? Reinvest it back into another property? So much of this can come as you get more confident in your Airbnb moving forward. As you develop out your business plan, it’s important to just get started.

What else would you include in your Airbnb business plan? I’d love to know in the comments below!

This post was all about Airbnb business plan writing.

This post may contain affiliate links, meaning if you decide to make a purchase via my links, I may earn a commission at no additional cost to you. See my disclosures for more info.